gst increase 2022

Feb 17 2022 - 123402 PM. Owing to the prediction of the third wave of Covid-19.

Gst New Era In 2022 Important Changes Effective 1st Jan 2022

You can receive your payments via direct deposit to your Canadian bank account.

. GST rates for insurance should be brought down. September 17 2021. The base payment is decreased in proportion to the increase in income level.

Allegations that PAP will announce GST increase on 18 Feb. GST rates changes hit industries and trade bodies. It needs to raise.

The Government has to start moving on the planned GST increase from 7 to 9 per cent said PM Lee Hsien Loong. So in this article we bring you key changes in GST rates from the inception of the GST law so far. This will give us time to adjust and adapt to the.

Sunday January 30 2022 0333 PM IST Budget 2022. GST oil drive govt revenue Share. GSTHST Payment Dates for 2022.

The Goods and Services Tax GST has always been a bane whenever it comes to dining in at restaurants or. This story has been. GJC has urged FM to raise the PAN card limit from Rs 2 lakh to Rs 5 lakh citing that many.

A Cloud-based GST software that helps you to automate your GST Return filing optimise Reconciliation results and increase ITC claim IRIS Sapphire. Budget 2022 Expectation. Joined Jun 22 2018 Messages 8271 Reaction score 4355.

Insurance industry seeks cut in GST increase in 80C investment limit in Budget 2022. A donor may exclude from his annual and lifetime gift tax exemption all gifts to hisher spouse as long as the spouse is a US citizen payments of tuition made directly to the donees educational institution and. Economists had previously said 2022 provides a window of opportunity for the Government to implement a GST increase even though there is never a good time to raise taxes.

29th August 2021 Taxpayers can get extended time up to 30th September 2021 to revoke cancelled GST registration if the last date for the same falls between 1st March 2020 and 31st August 2021. DPM Heng 950000 HDB households to receive GST Voucher U-Save rebates in October Correction note. In ts wishlist it has urged the government to increase the exemption limit of Rs 50000 for the senior citizens to Rs 1 lakh.

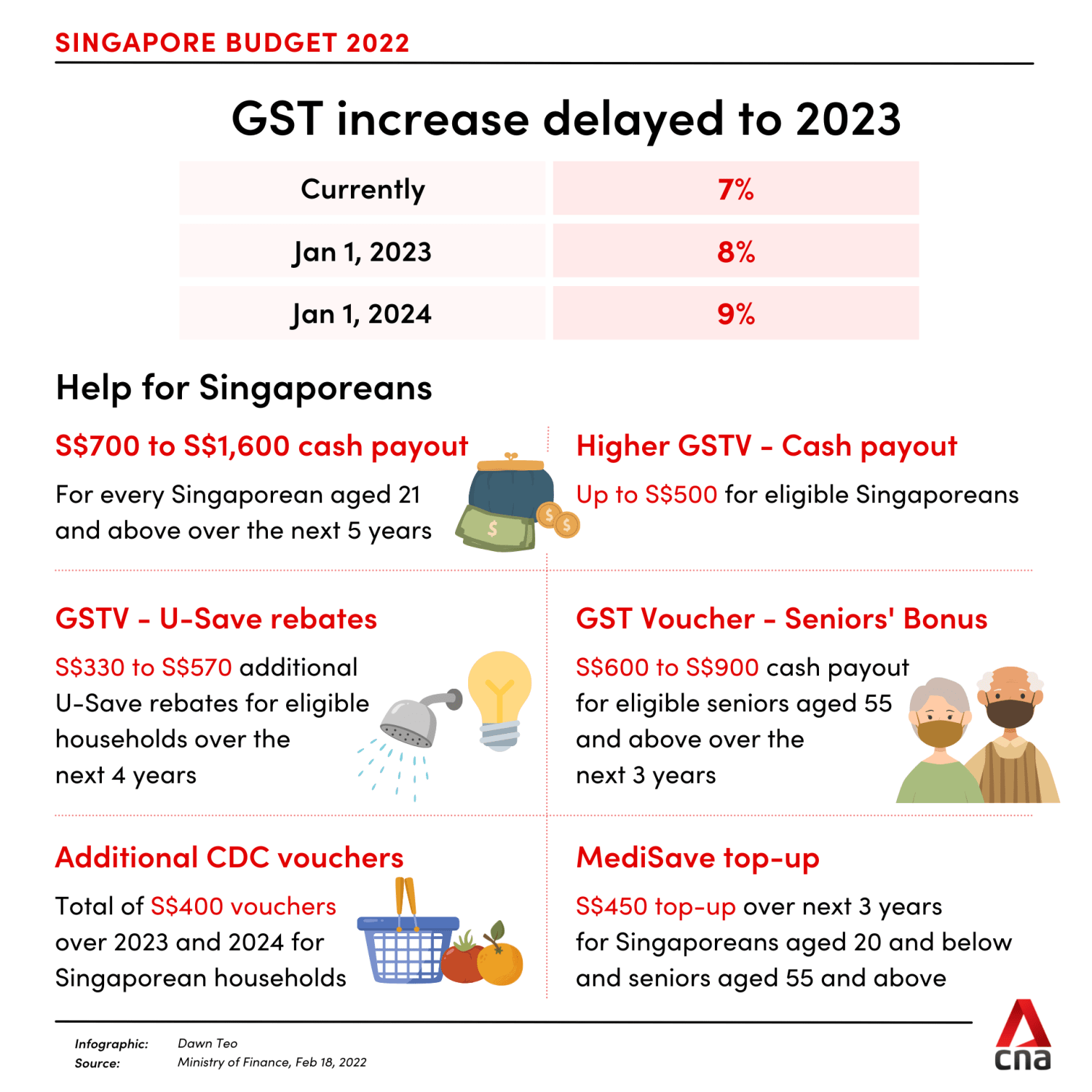

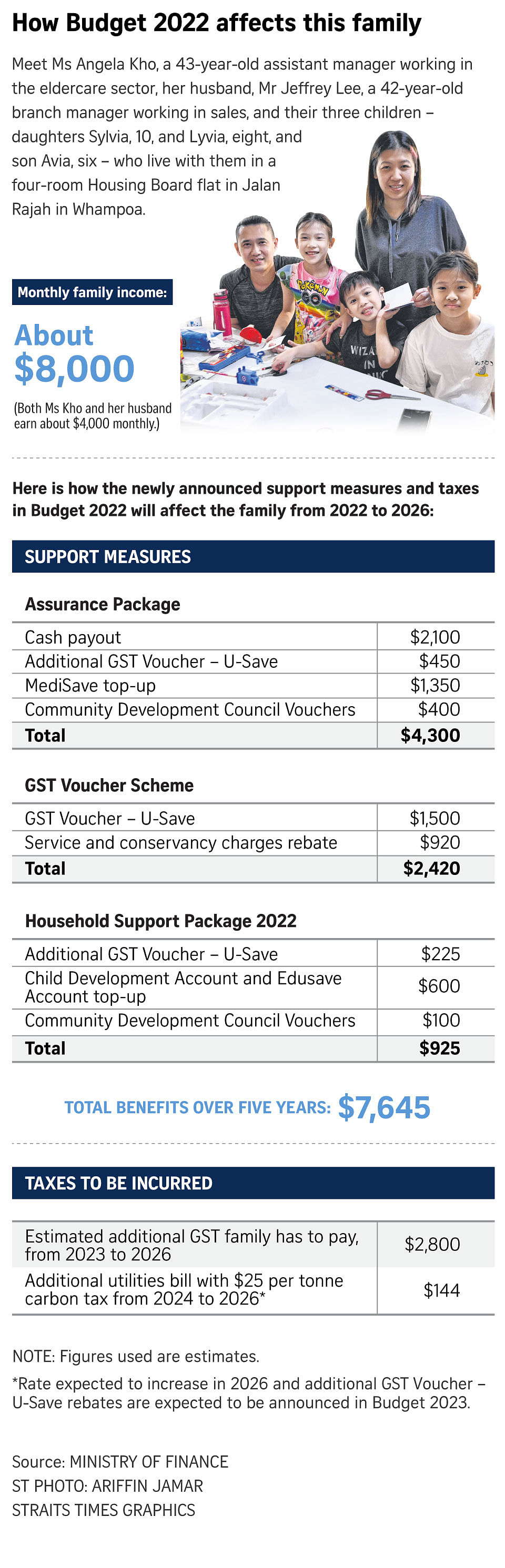

Increase needed in investment limits Union Budget 2022-23. The Government will delay the planned Goods and Services Tax GST hike to 2023 and stagger the increase in two steps Finance Minister Lawrence Wong said in his Budget speech on Friday. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

Budget 2022 will lay the basis for sound and sustainable government finances for. Without such increase retailers gross margin is affected on items sold after 1st January 2022 whose purchases were made at 5 GST before 31st Dec 2021 especially when GST calculation is done on MRP inclusive method. Jan 23 2022 6.

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. Divided by Sectors Retail Industry Unites on Low GST Demand. If the GST increase from 7 to 9 is all you got from Budget 2022 heres some more important information that youll need to know from effective dates to the government-implemented packages to help Singaporeans cope with the increase in expenses.

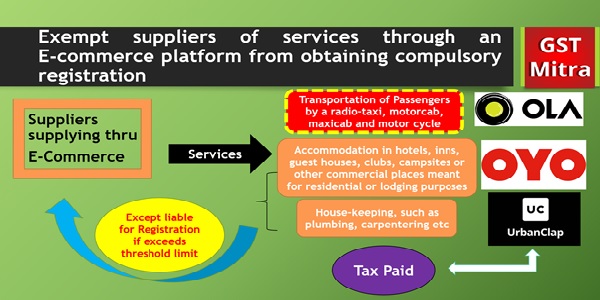

Jan 18 2022 1132 AM IST. Due to this Proposal GST Collection will increase small Dealer will not suffer because of non-payment of GST by Supplier. The hike in the GST rate on supply of bricks will come into effect from April 1 2022 and may significantly increase the cost of property construction.

With the Union Budget 2022 less than a week away experts from the retail sector in India are mounting their hopes of the government. From 1st January 2022 CBIC made the aadhaar authentication mandatory to apply for revocation of cancelled GST registration under the CGST Rule 23 in REG-21. ZeeBusiness January 25 2022.

GST increase to be staggered over 2 years starting from Jan 2023 SINGAPORE The Goods and Services Tax GST will be increased progressively rising to 8 per cent with effect from. In a meeting held in UP capital Lucknow the GST Council decided to increase the tax on supply of bricks to 12 with input tax credit benefits. GST Rates in 2022 List of Goods and Service Tax Rates Slab Revision Updated on.

TIMING OF GST INCREASE. IRIS Sapphire is an all in one powerful GST Solution for a seamless GST Return filing that supports multiple GST Return filing PAN level data view bulk operations advanced 2A-Purchase Register reconciliation tool. The first increase will take place on 1 Jan 2023 from 7 to 8 and the second increase on 1 Jan 2024 from 8 to 9.

A robust economic outlook is expected ahead to boost revenue receipts further. The surge in claims and the attendant payouts that both life and medical insurance companies faced this. He also gave a hint that the upcoming increase in the Goods and Services GST tax will be tackled in Budget 2022 which will be unveiled on Feb 18.

Pandemic has taught us the importance of buying insurance and the need for fiscal prudence and security Suresh Agarwal January 31 2022 181821 IST Indian Union Budget 2022. Anti-evasion actions by tax authorities coupled with a digital push boosted GST collections while high fuel taxes have added to the exchequers revenues. PM Lee noted that Singapore needs a vibrant economy to generate the resources to realise its goals and the government must have reliable and adequate revenues to carry out its social programmes.

He said that a lower GST rate and higher tax exemption limit could lead to higher number of people opting for insurance. Pandemic has very well taught us the importance of. Dgains rackgen and wwenze.

Increase in consumption has aided the uptick in direct tax kitty. The volumes then could make it revenue neutral Shah added. Earlier supply of bricks.

Everyone from business to consumers evaluates their position as a result of this change. What payments are excluded from the annual and lifetime gift tax exemption. GSTHST Payment Dates 2022.

That said after careful consideration from our Government the GST increase will begin on 1 Jan 2023 as announced in Budget 2022. Under GST if there is credit in credit ledger since inception of GST because of transitional period VAT service tax or excise Refund brought forward and till date un utilized then same may be Refunded to the dealer who can utilize that fund for. This article outlines the criteria of eligibility for the GSTHST credit payment its application procedure and other related information.

Jan 23 2022 1 Whats your view on PAP increasing GST to support profligate spending and irresponsible unsustainable plans. GST hike to take place between 2022 and 2025 sooner rather than later. 08 min read.

The GST increase will be done in two stages. Jan 20 2022 1247 PM IST. Increase healthcare expenditure above 25 of GDP.

Jewellers urge FM to reduce GST rate increase PAN card limit to Rs 5 lakh in Budget 2022. Impact Retailers in Textile sector is bound to increase their MRPSale price thus making them costlier for the end-consumers. Joel Rebello ET Bureau Last Updated.

Sutanuka Ghosal ET Bureau Last Updated.

Asuja Eserv Private Limited It Consulting Company Works With Clients To Help Them Solve It Problems Consulting Companies Solving Development

Gst Rule Change From January 1 Check What Gets Costlier Business News

New Gst Changes Applicable From 1st January 2022 Ask Masters

Gst Rates In 2022 List Of Goods And Service Tax Rates Slab Revision

Gst Rule Changes From January 1 Know What Will Get Expensive Cheaper In 2022

Pin By Karan Krishna On Efiling In 2022 Registration Audit Refund

Gst On Clothing Being Increased To 12 Indian Stock Market Hot Tips Picks In Shares Of India Stock Market Money Plan Investment Advisor

Income Tax Services In 2022 Income Tax Tax Services Income Tax Service

Bad News For Fashion Goods And Service Tax Goods And Services Bad News

Pin By Karan Krishna On Efiling In 2022 Filing System Indirect Tax Goods And Service Tax

Editable Bakery Donut Loyalty Card Template Donut Reward Card Template Bakery Flyer In 2022 Loyalty Card Template Customer Loyalty Cards Loyalty Card

Akhil Amit And Associates Is A Young Fast Growing Chartered Accountancy Firm Ca Firm With Its Head Office In 2022 Investment Advisor Chartered Accountant Finance